Investing can be an intimidating word. Oftentimes, people think they need a lot of money and/or experience to get in the game. In today’s day and age, that’s simply not the case. There are several options to invest with little money. In fact, younger people should be just as committed to learning how to invest as older people due to a concept called the time value of money. Essentially, money is worth more to me tomorrow than it is today.

Someone might ask me, “Can you loan me $1,000?” But, that $1,000 could be worth a lot more in seven years if I invest my money well. The interest (or discount) rate of what I could earn on that $1,000 somewhere else makes it worth way more to me in seven years’ time than it is today. When I give someone $1,000 I’m losing much more than $1,000 since I know what I am doing with my money.

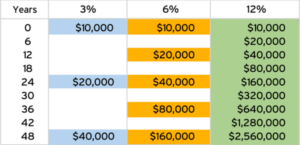

The Rule of 72 is a simple way to understand this concept. If you take the interest rate on any given investment and divide it into 72, the answer tells you the number of years it will take an investment to double. The chart below illustrates this well:

If you invest in something that gives you a return (an interest rate) of 6%, your money will double in 12 years because 72 divided by 6 is 12. So, a younger person’s money will go way further than an older person’s simply because it has more time to double. If you really look at that chart, it will wake something up inside of you. If that’s you, check out these ways to invest with little money.

Types of Investments

Paper Assets: Intangible investments such as stocks, bonds, mutual funds, ETFs, and REITs (definitions below)

Hard Assets: Tactile investments like real estate, precious metals, and land

Business Assets: Investing in the success of a business by providing capital in the form of money or assets

1. Long-term option: A Roth IRA

A Roth IRA is much better than a traditional IRA because you invest using after-tax dollars. That means you don’t pay a cent in additional taxes on the accrued funds as long as you’ve owned the account for at least five years and are at least 59 1/2 years of age before you make a withdrawal.

An important thing to remember about opening a Roth IRA is to do so at an investment bank—not a federal or state-chartered bank. Opening a brokerage account at an investment bank, such as Fidelity or Charles Schwab, will provide you will a much higher level and a wider range of securities that produce a larger return.

2. The Stock Market

Times are changing. There is an ever-growing number of digital platforms where you can get involved in the stock market with no minimum investment. Robinhood makes it easy to invest with little money and even offers users a free stock when they join. There’s a $0 account minimum and no transaction fees. Public is another option that offers thousands of stocks and ETF options with no commission fees on trades and no account minimums. Money Under 30 describes it like this, “Public makes investing easy and user friendly: you simply pick your stocks and ETFs, enter the amount of money you’d like to invest, and Public “slices” off a portion of the share to fit the amount you’ve chosen.” It’s a great way to gain financial literacy, even if you just put in $20 or so.

In addition, you can have your stocks professionally managed with little to no upfront cost. Typically, the investment bank/stockbroker you work with will take a percentage of your portfolio’s appreciation annually.

3. ETFs (Exchange Traded Funds)

When you purchase an ETF, you purchase a basket of securities that can include stocks, bonds, and/or commodities. For instance, there can be an ETF that is just a collection of stocks that have to do with oil or tech. The price of an ETF’s shares will fluctuate throughout the day as shares are bought and sold. ETFs are notorious for their low fees, and they’re a great way to diversify your portfolio.

4. Mutual Fund

Mutual Funds are like ETFs in the sense that they contain a variety of different assets. However, mutual funds aren’t traded like stocks—instead, they can be bought at the end of each trading day at a calculated price. They are actively managed instead of passively managed which means that a professional investor constantly monitors them. That makes them more expensive than ETFs (ranging from a few hundred to a few thousand dollars), but they typically earn a higher return because they get more attention.

5. REITs or Real Estate Crowdfunding

Real Estate investing can have a high barrier to entry and require a higher skillset. However, there are a few options to invest in the market with little money. Real Estate crowdfunding allows people to invest a smaller amount of capital into properties and/or companies. The companies win too because they get access to capital they might not have been able to raise otherwise. Fundrise is an investment company that can help you expand your portfolio with both real estate crowdfunding and REITs.

A REIT (Real Estate Investment Trust Fund) is a company that owns, operates, or finances income-generating real estate (definition from Investopedia). It’s essentially a mutual fund for real estate investing! When you invest in a REIT, you own a paper asset that allows you to earn dividends from real estate investments without having to buy, manage, or finance the properties yourself. It’s a great way to get involved in real estate investing when you don’t quite have the capital to purchase an entire property yourself—or even if you do! The returns are pretty good.

If this article inspired you to grow your investment portfolio, we recommend that you check out WealthBuilders University. There are several lessons on investment and money management that can really help you get in the game.

I love this and thank you.

This is very interesting to me and my family,I like the wealth building a plan now, that’s something I can get in to and learning about the money game.

I never know how to start investment it’s probably the best way to do it for me to start very small with capital since I’m drawing social security disability. It’s time for me and my money to make moves now and forever!