If you want to start or scale your real estate investing portfolio, it is time to prepare. Do not be caught unaware and unprepared for the right opportunities. Money is attracted, not pursued – if you are not prepared with sound real estate knowledge and readied finances, that million-dollar deal will not come your way.

While many markets are still overvalued and interest rates are high, expert real estate investor Billy Epperhart predicts that prime investing opportunities will surface in late spring and summer of 2024.

Is It a Good Time to Invest in Real Estate?

The psychology in the real estate market has started to change. Interest rates have remained high, and sellers are realizing that they may not get as high of a price as they were able to in the past. In fact, several markets in America are softening– homes are sitting on the market for longer, and prices are being reduced by hundreds of thousands. For example, in Colorado, housing supply is 2.7 months, which is a 17.4 percent increase year-over-year.

If you see a good deal and have the financing to secure it, you can still buy now. Here is why: if you can hit your profit margins with high interest rates, you will only increase your cash flow when lower interest rates come around again and you refinance your property.

However, we believe that optimal times for real estate investing are coming between late spring and early summer of 2024.

The rest of this economic update will explore why, including:

- The irregularity in the bond market and what it means for your investments

- Inflation and interest rates

- The average American’s financial strain

- How real estate investors should position themselves

- Coming real estate opportunities in 7-12 months

- What the Bible says about today’s economy

An Inverted Yield Curve Indicates Impending Recession

Typically, long-term bonds pay investors more than short-term bonds because they involve more risk. An inverted yield curve means just the opposite: currently, two year, short-term bonds are paying more than long-term, ten year bonds.

This is a sign that a recession is on the horizon. There has never been a time in US history where a recession has not followed an inverted yield curve. Banks make money by borrowing for a short period and lending for a longer period. In other words, banks take your deposits and lend them to people who want long-term loans.

An inverted yield curve affects the profitability of banks and makes them less willing to lend to individuals and businesses alike, which slows the economy.

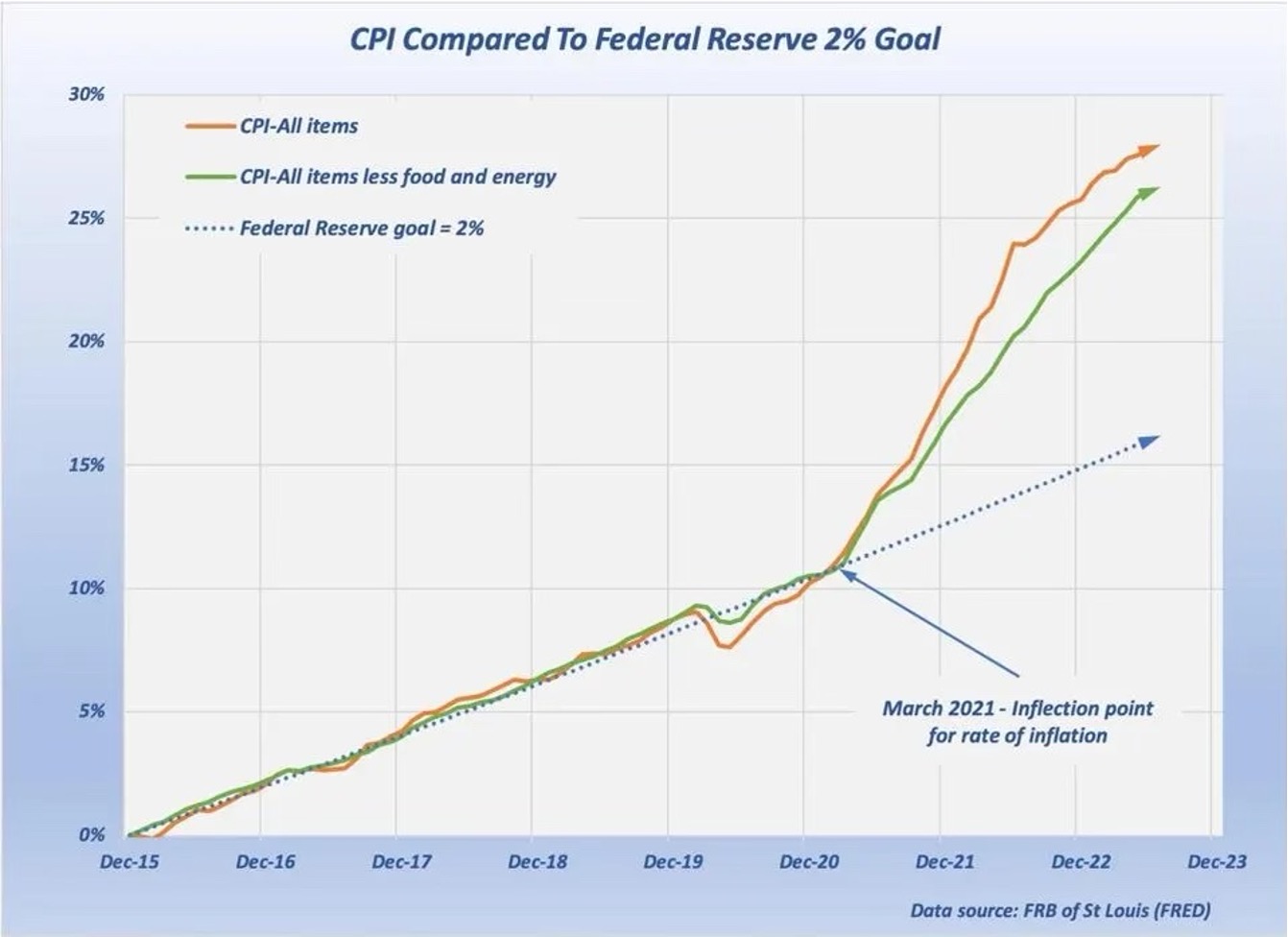

Inflation is Decreasing

As of mid-September 2023, inflation is at 3.67 percent. This is above the Federal Reserve’s target rate of 2 percent. The Federal Reserve will most likely maintain or continue to raise interest rates until the economy rests at the target inflation rate.

Why? The Federal Reserve typically raises interest rates during inflationary periods because it makes it more difficult for people to borrow money. Therefore, the value of the dollar rises because there’s less cheap money circulating in the economy.

As we will see in the next section, inflation will most likely drop and the prices of goods and services will become more affordable because, as things are, it is becoming more difficult for people to live.

Prediction: Mortgage rates will remain the same / slightly increase over the next year

From Wall Street to Main Street

So, how does an inverted yield curve and inflation affect the average American? Here are three ways wall street is trickling down to main street:

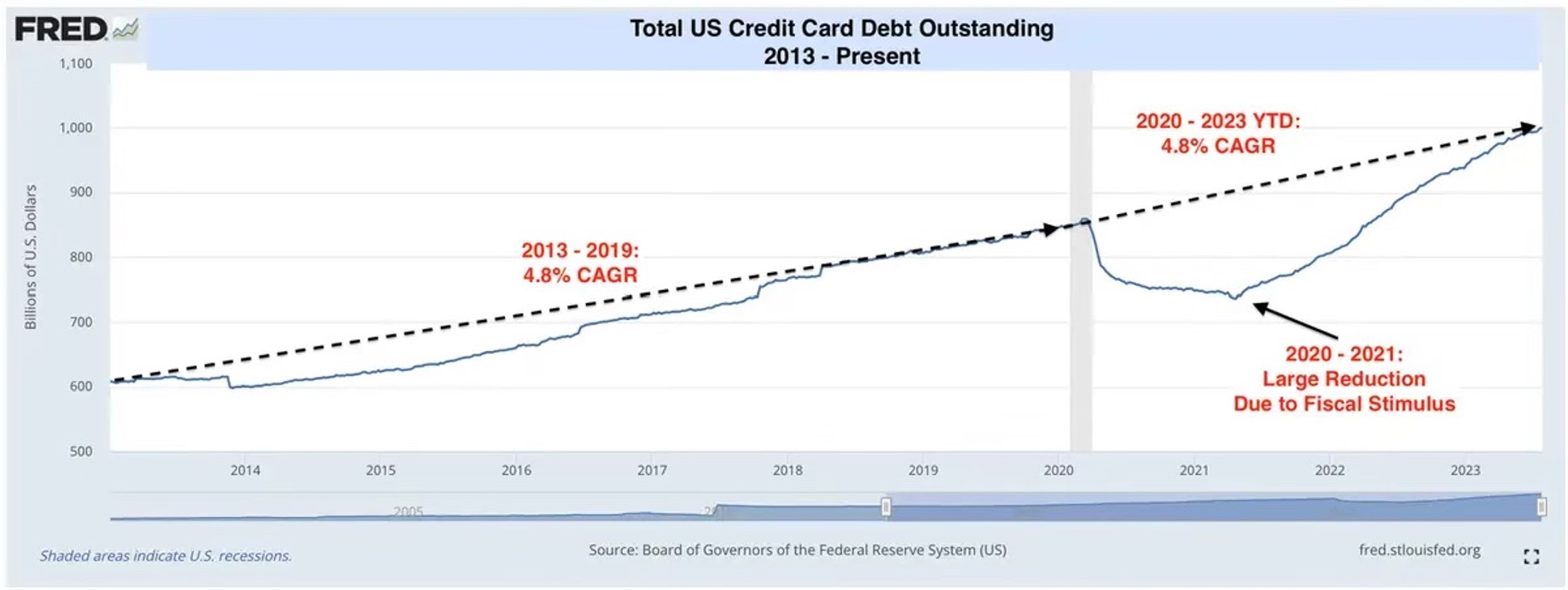

1. More Debt:

For the average American, credit card debt is very high. The inverted yield curve and rise in consumer debt indicates that the economy is getting tighter. People need to borrow more money in order to live, yet commercial banks are pulling back on lending.

2. Difficulty for First Time Homebuyers:

First-time home buyers and young families cannot afford to buy homes at current interest rates. They have been priced out of the market. Would-be second and third time homebuyers are locked in low mortgage rates, so they are sitting on their properties rather than buying new ones. Housing supply is still tight.

3. Inflated Higher Education Costs:

College tuition has risen by nearly 1400% , and student loan payments have kicked back into gear.

Listen to “The Time is Now: Real Estate Market Update” on The WealthBuilders Podcast.

A Word to Current Investors: Ride The Real Estate Cycle

If you own investment property already, do not be discouraged when prices start to decrease. Remember, when somebody cannot afford to buy a house, they still need a place to live. Because of that, your rents will hold up in what appears to be recessionary times that we are entering.

Real estate is not like the stock market. Many people see the market go down and they start selling. I am giving you permission to chill out– the real estate cycle will cycle. Prices will go down, and they will rise.

Real wealth is made in real estate when you ride at least two cycles. (A cycle includes four phases: recovery, expansion, hyper supply, and recession.) You can make outstanding wealth when you ride three or four cycles, and then do a 1031 exchange into something else.

Your Advantage

The Bible is plain – the wealth of the wicked is laid up for the righteous (Proverbs 13:22). Isaiah 48:17 says:

“This is what the Lord, your Redeemer, the Holy One of Israel says,

“I am the Lord your God, who teaches you to profit (benefit),

Who leads you in the way that you should go.”

As God’s people, we do not have to fear. Joseph sowed in famine and reaped a hundred fold, and we can prosper when others cannot see the opportunities.

Instead of looking at this recessionary period as a dismal and hopeless time, it is time to get prepared. If you learn what you need to learn and prepare your finances, you are going to be in good shape when the right opportunity(s) come along. Housing prices will dip. The question is, will you be ready?

We have just the course to ensure that you are.

Minimize your risk and maximize yur profits with The WealthBuilders Real Estate Investing 101 Masterclass!

With over 8.5 hours of content, 10 courses, and 53 lessons filmed directly for the Masterclass, there are no real estate investing courses on the market as comprehensive as this one. In addition, there are faith-based teachings so that you can ground your investing journey in your Christian values.

Thanks for your continued support, win win cooperation.