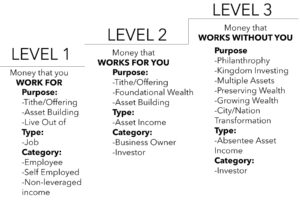

Some people think that all income is the same. You go to your job, earn a paycheck, pay your bills from that paycheck, and do it all again next month. I am here to change that perception. I believe that we were meant for more than just getting by. I believe that we can use money as a tool to live an abundant life and make a global impact. I believe money is meant to free us, not to shackle us. That is why I have developed these three levels of income:

Money You Work For (Income Level 1)

Level 1 income is what I just described, what we are all familiar with. You are an employee who earns a paycheck to pay your bills and purchase the things you need and want. It is non-leverage income, and it is not being used for the purpose in which it was intended.

Everybody starts somewhere, and the majority of people start their journey of WealthBuilding at Level 1. Most people also stop there. I believe that this is just a stepping stone to get you to a place of financial freedom. I believe that if you use your level 1 income properly, you can absolutely make your way to level 3. Wealth is not just for those that were born into it.

You need to use the money you have at level 1 to begin building and acquiring assets. Don’t just spend this money, INVEST IT.

Money That Works For You (Income Level 2)

Level 2 income is what I call “foundational wealth.” Level 2 income comes into your life, it pays for your expenses, even some of the things you want to do or buy, but also it’s for asset building as well. It’s like a snowball going downhill. Once you begin to establish Level 2 income, you begin to build assets and as you begin to build assets and your income increases off of those assets, then you’re able to acquire more assets and the snowball rolls over again and then you have more income come into your life.

Level 2 income isn’t completely hands-off, yet. You still have to manage your assets, as a property manager has to manage their properties. You shouldn’t spend more than 10 hours per week managing your portfolio, but you should be able to live off of the income. That is the definition of leveraged income.

Money That Works Without You (Income Level 3)

Level 3 income is when your assets are paying you enough to live out of, but you are hands-off. You are still making the decisions and calling the shots, but not a lot of time is involved here.

Real Estate investors can use managing companies to manage their assets for them, which I suggest if your portfolio is larger than 20 assets.

If I were to give you a dollar and say to you “can you go and take this dollar and turn it into $2” or “can you take this dollar and turn it into $5” most people would not know how to cause that money to double. They wouldn’t know how to actually increase what I had given to them. That is the difference from those at Level 1 and those at Level 3. This is one of the many things you will learn on your path to financial freedom.

If you are starting at level 1, be encouraged today to take the next step, steward your money well, and invest it so that you can reach financial freedom.

I believe the best investment you can ever make is in yourself. This is why you to go to seminars, workshops, purchase teachings and courses so that you can learn to go up the chart. In my opinion, real estate is one of the best ways to acquire assets and build wealth. I am hosting a Real Estate Workshop in Denver, Colorado this October. If you are ready to invest in yourself, I invite you to purchase tickets here. If you are unsure, you can click here to learn more information about the workshop.

I hope to see you there, and best of luck on your path to financial freedom!