Entrepreneur or not, living under debt is something you don’t want to do. Debt is oppressive and builds with magical ability. And as an entrepreneur especially, you want your assets to be free of danger.

Oftentimes, your pocket will be taxed when starting a business. Let’s be realistic here: entrepreneurialism is in no way about making money immediately. It’s an investment. I’ve met many small business owners dipping into their own bank account for little things here and there.

Starting a business – especially your first – will inevitably affect your bank account. And whether or not this dipping is causing debt or causing more debt, you need to get free.

According to Nerdwallet.com, American consumers are – as of 2014 – 11.62 trillion dollars in debt. What does this mean? Frankly, it means that debt is a massive problem plaguing America. Today is the day to start tackling your personal debt.

1. Cut up or freeze all but one card.

Break out the scissors and destroy those cards. Or you can literally get a container, fill it with water, place that card into the container and stick it in your freezer! Whatever it takes to make yourself stop using the cards as an excuse to bury yourself in debt.Beware: don’t just cancel your accounts because that may damage your credit score. Instead, stop using the accounts and pay them off. That will help improve your score.

2. Pay off current charges every month or stop using the card altogether.

You’re down to one card. You can either keep using it but make sure to pay off the current charges each month, or simply stop using it. The key here is to be religious.The following steps will be heavy and difficult if you don’t maintain this one. Prevent further debt while you move forward in eliminating debt.

3. Make the minimum payment on all debts.

Don’t be sporadic in your attack to tackling debt. Start a rhythm. Make the minimum payments regularly on all of your debts. It might take a season or two to get into this rhythm, but it’s your first real platform to reach to move forward into eliminating your debt. Then you can start accelerating your process.

4. List your current debts.

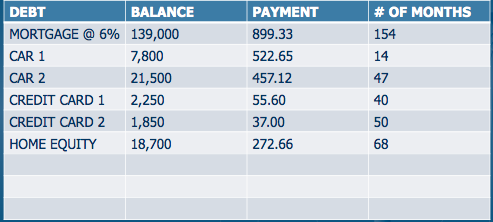

Using an actual sheet of paper, list your mortgage, car debt, credit card, school payment, etc. List the debt, the balance and your current monthly payment without the taxes and insurance. We just want to look at the hard number here.Now, divide the minimum monthly payment into the balance and find the number of months it would take to finish each debt. Here’s an example of what it might look like when you’re done. This is a starting place for all of the following steps.

5. Begin with the debt that can be paid the quickest using the minimum monthly payment.

By this, I mean the debt that can be paid off in the shortest number of months, not the one with the highest interest rate. So, according to the debt list we just made, that would be starting with Car 1. We’re going to tackle this debt with some oomph.

6. Determine your winning percentage.

Your winning percentage is going to be the extra room in your budget. Now, I talk a lot about living on 70% in the light of eliminating consumer debt. Ideally, you’ll be investing 10% and using 10% to pay off your debt. But for many people in heavy debt, it would be better to take the 10% that you personally invest and use those funds as the winning percentage to get out of debt (20%). If you’re not in heavy debt, keep investing.So what if you’re living on 100%? Dig around in your budget and find the ten percent, or whatever your winning percentage will be. Here are some ways to find your winning percentage (I’m sorry, but they’re not the most fun):

What can I sell?

What expenses can I reduce or eliminate from my life (Does the Latte Factor apply)?

How can I earn extra money?

Scrounge together a winning percentage. Getting out of debt is like digging trenches – it’s hard work, but when it’s done, the waters can flow.

There are nine steps to this program I teach. These first six are really the base steps to set you up for success. With intentional practice, this program can get you completely out of debt (including your mortgage!) in 5-8 years.

What is the main thing that keeps you in debt? Leave an answer in the comment section below!

For more wealthbuilding information, check out my latest book: Money Mastery!

And consider signing up for new blog posts. By doing so, you’ll also receive a FREE copy of my ebook – Finding Your Courage to Get Started! Sign up below!

FREE eBook

Subscribe for Finding Your Courage to Get Started