Welcome to the VLOG everyone! Today I am going to answer a question from Estevan. He asks, “What do you mean when you say the payments for your first few years go toward the principle and the interest on your loan payment? Are you saying that after a certain period of time, your payments go straight to principle?”

[Transcription]

Estevan asks a great question!

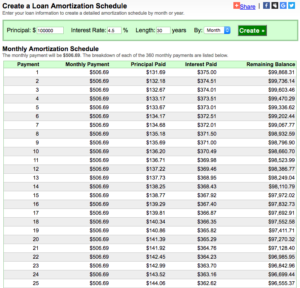

I have had an amortization schedule printed for you.

What that basically is, is a loan payment schedule. An amortization schedule shows you a break down of your monthly payments – what you are paying toward the principle and what you are paying toward interest. The example we have provided you would be for a $100,000 loan. So the house would be worth anywhere from $105,000 to $120,000 normally speaking, due to the fact that you would be able to borrow around $100,000 after your original down payment.

For example with FHA loans right now, someone only needs to put 3% down, which is $3,000. That would mean someone can buy a $103,000 house by putting $3,000 down and then they would be able to get a loan for $100,000.

Or someone who is doing more of a conventional loan, and did not want to pay what we call mortgage insurance, might buy a $120,000 home and put $20,000 down and borrow $100,000. But let’s just say your loan is $100,000 — which is the number I am pointing to on the example.

The next number I am pointing to is the interest rate. Now I know you can get interest rates at 3.75 etc., but I used 4.5 % as an example for 30 years. If you look at it, you must understand the principle and the interest paid on loan payments changes every month. Now not the amount you owe, the amount you owe is the same. In this case the payment each month is $506.69 – how much is applied to principle and how much is applied to interest changes every month. Every month.

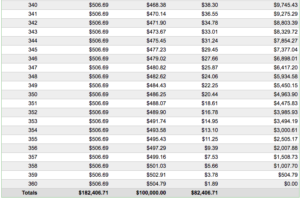

Let me show you this. This first month, only $139 of the $506.69 actually goes toward the principle to pay down the loan. $365 that first month is actually interest. Now that is the first month. If I go to the last month of the loan, 360 months later… the loan payment is exactly the same – $506.69. But the amount of principle paid that month is $504.79 and the interest is only $1.89.

You say, well what does that mean?

That means at the beginning of a loan when you are making payments, more money goes toward interest than it does toward the principle.

When I was twenty five and bought my first house, I had a banker show me an amortization schedule. He said, “Let’s look at the first year of what you would be paying toward the principle and interest. If you paid all of those months on time each month, you would only be paying about $1,500 toward the principle and around $4,000 in interest the first year.” He continued, “Do you want to save $4,000? If you want to come in here and give me a check for $1,500 for payments 1-12 of the principle, you can cut out the $4,000 in interest. You need to come in here and list out the first 12 months of the principle and say you want to make those principle payments for the first 12 months. By doing this you will avoid $4,000 in interest.”

So this is important. I encourage every one of you to print up an Amortization Schedule, whether that is for your personal property or rental property – whatever you have mortgages or loans on. When you hear these programs that say, “We will show you how to pay off your mortgage in 10 years…” this is exactly what they are showing you!

Remember to leave your questions in the comment section and I’ll try to get to them in the video.

Join me every Thursday for tips on investing in real estate. And make sure to leave your questions in the comment section!

Question for you, please.

We are completing our final payments on a mortgage on a vacant land parcel in Florida. The amortization schedule relevant to my question reads:

04/01/2020. 898.83. 6.07. 892.76. 148.34

05/01/2020. 898.83. 0.87. 897.96. -749.62

06/01/2020. -753.99. -4.37. -749.62. 0.00

What should our payment be for may 1 to satisfy this mortgage? Thank you

Hello, Beverly!

Thank you for your great question! I would be more than happy to answer it. In order to do so, would you mind sending me an actual copy of your amortization schedule? You can email me at info@wealthbuilders.org.

I look forward to hearing from you soon!

Blessings,