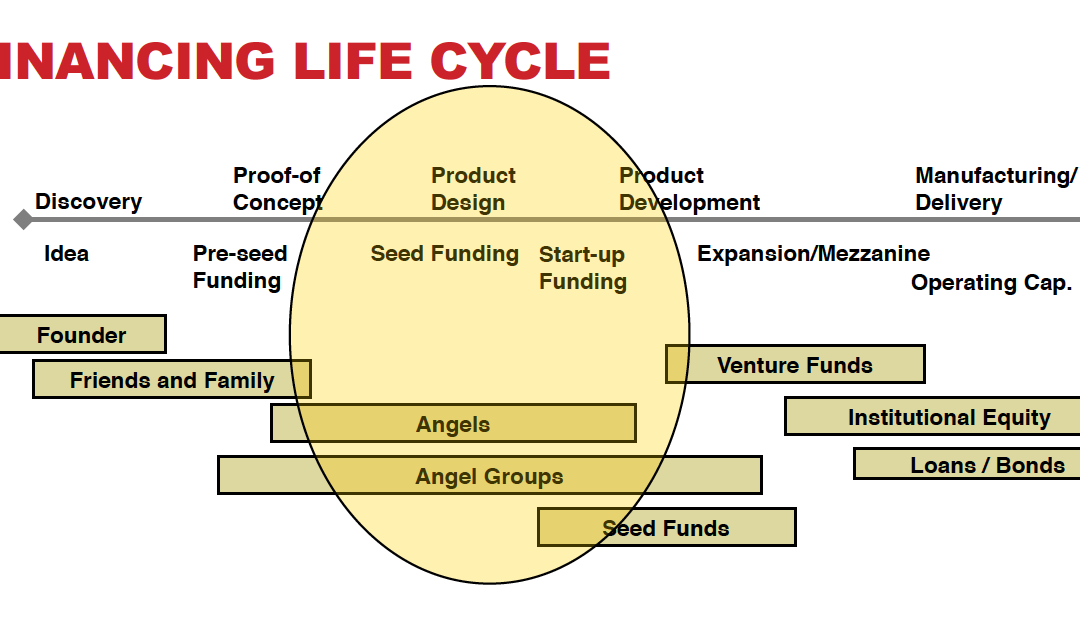

Last week, we started talking about funding for your business. There are levels of funding that an entrepreneur goes through as he or she starts a business. After you’ve gone through the phases of funding yourself and obtaining funds from family, friends and crowdfunding, it’s time to move to the next level: Angel Investors.

The Angel level is typically the first true round of funding. The friends and family levels aren’t normally big enough to be considered a round. At the Angel level, the round of funding is raising about $250-$500,000 in cash.

3. Angel Investors: Angel investors are wealthy individuals who believe in free enterprise and the entrepreneurial spirit. They are normally centered around specific cities to help them grow business. Angel Investors usually come in at the proof of concept, product design and product development stages. They provide seed funding and start-up funding, and sometimes even operate at other levels with a company.

Angel Investors are usually accredited investors. Accredited investors have a net worth, without their home, of $1 million and they make either $200,000 a year as a single person or $300,000 as a couple. The exception to this with Angel Investors, is if an offering is made that allows for up to 35 non-accredited investors. In that case, an angel could be a non-accredited investor. It all depends on how the fund is set up and the designation of the person handling the fund.

Angels Investors provide less equity by Total Dollars. This means they take a lower equity position when they provide money to you than what a Venture Capital Fund would take. A Venture Capital Fund will typically come in and take over. They’re not only going to take 2 board seats, they’re going to take control! An Angel Investor on the other hand, won’t take a seat on the board unless they put quite a lot in.

So who are Angel Investors?

- Angel Investors are often successful entrepreneurs or retired business persons.

- They tend to be active investors providing money, expertise, and their network.

- They often contribute to their local ecosystem (mentoring, judging, educating).

- They’re usually accredited investors – SEC definition (US & a few others).

- Angles invest their own money (they’re not money managers).

- Angels generally invest in local companies with high-growth potential. Most angels are in a local area.

- They invest in businesses not run by family. They’ll take a look at your corporate structure and help you out.

What motivates Angel Investors?

- They desire to help entrepreneurs.

- They want to stay engaged personally – they use skills and experiences to help build a business.

- They enjoy giving back to community or university.

- They prefer an active form of investing – not just watching markets. They don’t want to just sit at home trading on the computer.

- They’re looking to find their next opportunity.

- They want to network and learn.

- They’re looking for a Return on Investment!

The Angel Investor-Entrepreneur Connection

- Many Angel Investors provide mentoring before and after investment. There’s a group in Boulder called TechStars. It’s known nationally and starting to be known internationally. They find up-and-coming people in the tech industry and put tech titans with them to coach, mentor and provide capital.

- Many serve as board members or observers.

- Some join ventures as a C-level executive for an interim period.

- They often invest in multiple rounds to ensure entrepreneurs can grow.

- They develop relationships with Venture Capital firms for expansion capital.

- Angels help lead the Mergers and Acquisitions process early on.

- Angel monitoring/mentorship improves startup health.

- A Harvard/MIT study shows Angel Investor support improves startup success rate!

The world of Angel Investors is a largely untapped market. There are many accredited investors in the world, but not many of them look to becoming Angel Investors. If you’re ready for this level of funding, I say get out there and start looking!

So here are some examples of companies backed by American Angel Investors: Home Depot, Costco, Google, Yahoo, Facebook, PayPal, Best Buy… Will your business be next?

Join me every Monday for tips on leadership and entrepreneurship.